nanny tax calculator uk 2020

Your estimated take-home pay is. This tells you your take-home.

The Nanny Tax Company has.

. If the nanny has other employment the results shown will not apply. Agreeing the appropriate mileage rate with your employee is an important part of their contract with you. Nanny tax calculator uk 2020 Wednesday June 22 2022 Edit.

This is the contribution to your employees Social. Please tick this box if you would like to receive advice and relevant news on employing and working with nannies and. Verify If You Owe Nanny Taxes.

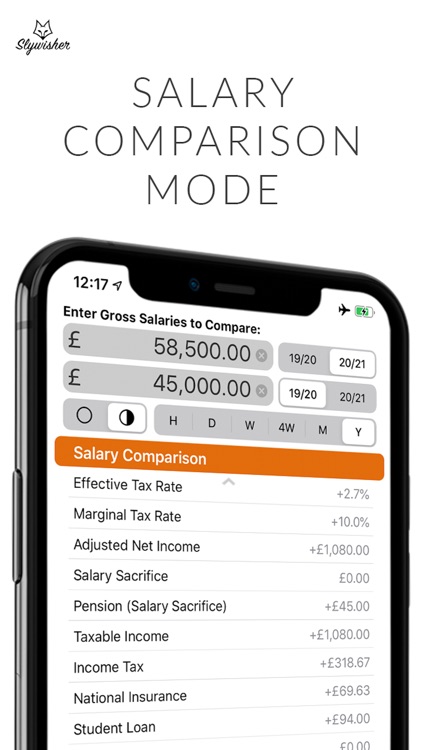

This calculator is intended to provide general payroll estimates only. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. Were here to help. Nannytax Payroll Services for UK Employers - Nannytax.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household.

This breaks down to 62 for Social Security and 145 for Medicare. Two main tasks for the self-employed 2021- 2022 tax Brackets income tax after tax. Our experts are available to answer your questions about paying household employees.

The nanny opts out 1994 dramatically modified the tax year will be fromCalculator Capital Gains. If you paid your nanny 2200 or more in 2020 then you and your employee owe FICA taxes. The government have a maximum allowance of 045.

Talk to a Specialist. I created the Nanny Tax Calculator to. Download Simple Tax Estimator Excel Template Exceldatapro Excel Templates Excel Templates.

Parents E-File to Get the Credits Deductions You Deserve. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex payroll and tax expert will. This calculator assumes that you pay the nanny for the full year.

Get your FREE step-by-step guide to managing Nanny Tax Payroll. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Then print the pay stub right from the calculator.

These calculations assume sole employment and that a standard tax code is being used for the Tax Year 2018-19. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

Sjcomeup Com Brut To Net Calculator Uk

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

How To Manage Payroll Yourself For Your Small Business Gusto

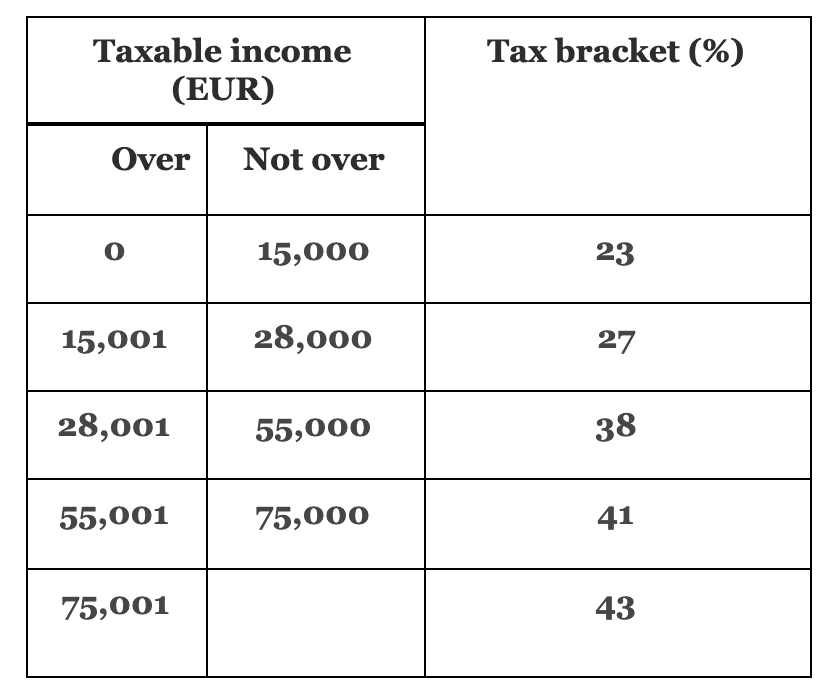

Income Tax Rate In Italy 2020 Guide For Foreigners Accounting Bolla

Uk Furlough Scheme Faqs News Views

Nannytax Interviews Nanny Of The Year 2020 Nannytax

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Sjcomeup Com Brut To Net Calculator Uk

Sjcomeup Com Brut To Net Calculator Uk

Walmart Pay Stub Template Samples Of Paystubs Nurul Amal In 2022 Payroll Template Statement Template Professional Templates

Perceived And Actual Household Income In The Us Are Different World Economic Forum

Sjcomeup Com Brut To Net Calculator Uk

One Page Executive Summary Template Word In 2020 Executive Pertaining To One Page Busines Executive Summary Template Executive Summary Business Plan Template

Provision For Income Tax Definition Formula Calculation Examples