osceola county property tax rate

With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. 407-742-4037 Property Taxes FAX.

Osceola County Property Appraiser Richr

For comparison the median home value in Osceola County is.

. 407-742-3995 Driver License Tag FAX. Osceola County Property Appraiser. OSCEOLA COUNTY TAX COLLECTOR.

407-742-4009 Local BusinessTourist Tax. Osceola County Florida Osceola Countys overall proposed tax rate will remain at 82308 mils for the general fund EMS library and environmental lands under the County. Osceola County collects on average 114 of a propertys as.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Irlo Bronson Memorial Hwy. Ad Find The Osceola Property Tax Records You Need In Minutes.

Officials signed off on a proposed rate. Washtenaw County collects the highest property tax in. Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a. Ad View all county offices info for free including hours address and phone numbers. The Tax Collectors Office provides the following services.

The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of. Osceola County collects on average 105 of a propertys assessed fair. Please fill in at least one field.

If you are contemplating. Osceola County commissioners voted this week to propose a flat property tax rate for the 12th-straight year according to a news release. To be eligible for the program the taxpayers estimated taxes must be in excess.

The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Effective July 1 2004 the Tourist Development Tax increased to 6 in Osceola County.

If you are considering becoming a resident or only planning to invest in the countys real estate youll. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Contact the Treasurers Office.

Find Osceola Property Records Online Today. Search all services we offer. Learn how Osceola County levies its real property taxes with our detailed review.

The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200. You can use the Michigan property tax map to the left to compare Osceola Countys property tax to other counties in Michigan. Tourist Development Tax Osceola County Code of Ordinances Chapter 13 Article III Tourist.

The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective. Search for all public records here including property tax court other vital records. Osceola Tax Collector Website.

Property Tax By County Property Tax Calculator Rethority

Osceola County Fl Land Lots For Sale 311 Listings Zillow

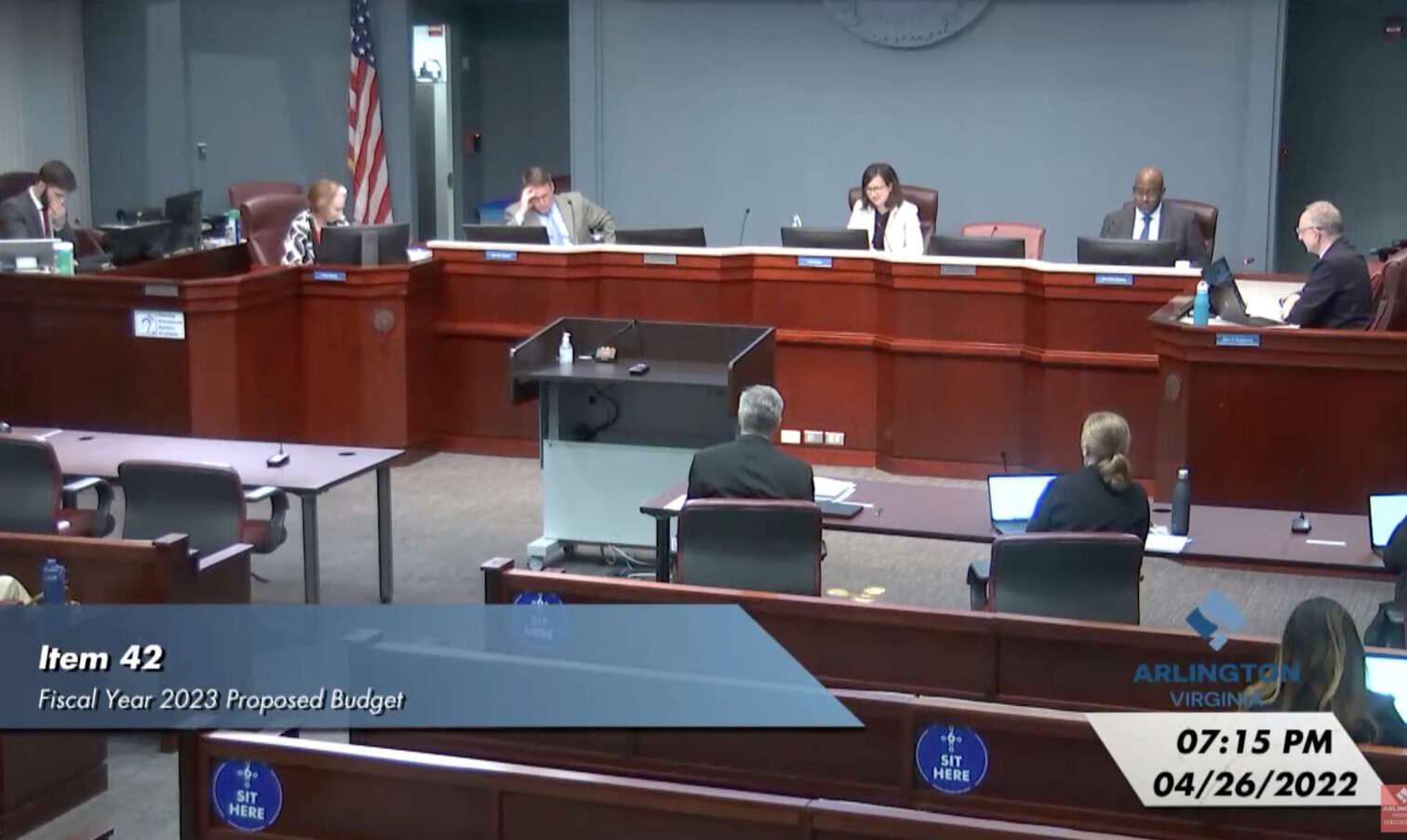

New 1 5 Billion County Budget Holds Tax Rate Steady Creates Climate Office Arlnow Com

Indian River County Auditor Homestead Exemption

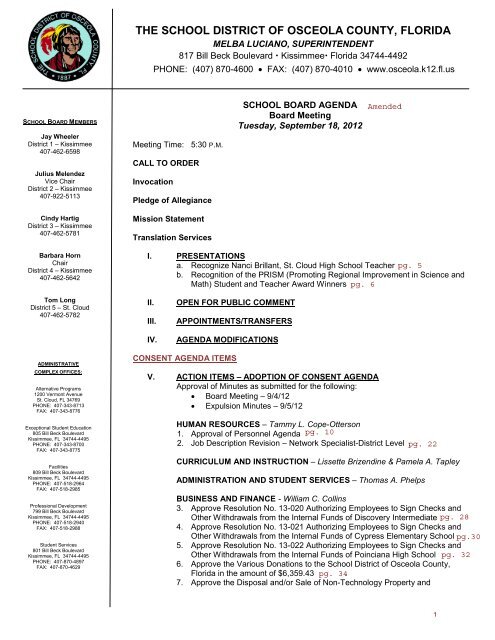

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Fl Property Tax Search And Records Propertyshark

What Is A Florida County Tourist Development Tax

Home Osceola County Bs A Online

The School District Of Osceola County Florida District Home

Property Tax By County Property Tax Calculator Rethority

Florida Property Tax Calculator Smartasset

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Annexations City Of St Cloud Florida Official Website

Osceola County Property Appraiser Linkedin

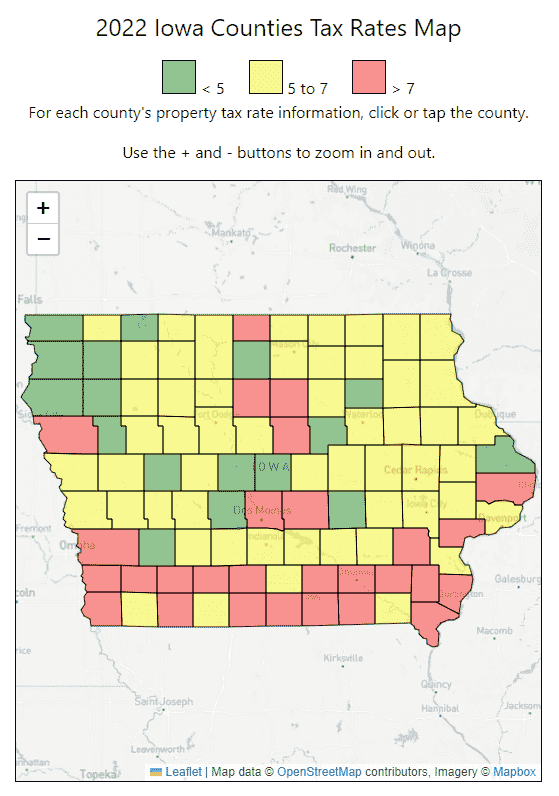

2022 Iowa County Property Tax Rates

Florida Property Tax H R Block

Osceola County Property Appraiser Office Recertifies Certificate Of Excellence One Of Four Nationwide